Understanding the economic shock of Covid

- kathrinmaurer

- 4. Dez. 2020

- 2 Min. Lesezeit

Predicting the path ahead has become nearly impossible, but we can speculate about the size and scale of the economic shock.

A steady flow of money, goods, services and the people to make them flow is essentail to a so called "healthy economy". That flow is severed right now by life-saving "stay at home" orders. A resession is already happening and we are also not able to stop it. Nevertheless it is important what kind of recession it will be and how the recovery will look like.

Authors from 'Boston Consulting Group' point out that recessions and their recoveries come in various shock shapes. They depend on how hard the crisis hits the supply side of an economy. This includes inputs and capital like machines, factories, software, labour and workers including productivity and how we use labor and capital in an effective and productive way.

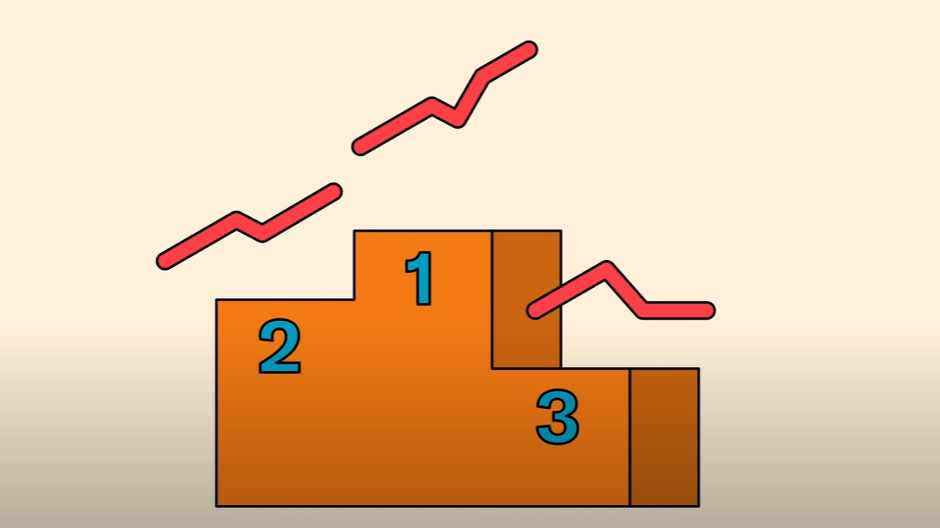

From best to worst we have V, U and L recession shock shapes.

The V shape is a one time dip. You can see the grows dips but is is recovering to its pre-crisis level and rate. The U shape is much more costly because the credit flow is disturbed and the growth drops very fast and is never rebounding to its pre-crisis path. Last and least: the L shape. That is the worst! Credit is severely disturbed, not once but perpetually and there is very little new investment. In this shape the economy never recovers its prior output path. The crisis in this case leaves permanent structural damage to the economy's supply side.

At the moment we have to deal with a double shock. The financial system shock and an epic freeze of the real economy including households, firms and government that deliver real goods and services. No country has a perfect plan how to deal with these two major shocks but there are actions which should help overcoming it. One big step and you can even call it a solution or at least an important factor is innovation. On the medical side: vaccines, treatments and capacity innovations are needed. One the economic side we will need policy innovations. We need correct ways of delivering the money to those who need it. Zero interest brigde loans to households and firms are just one example for potential solutions to help make a real difference.

Kommentare